| Author | Message | ||

| Randall (Randall)

Member Username: Randall Post Number: 627 Registered: 1-2003 |

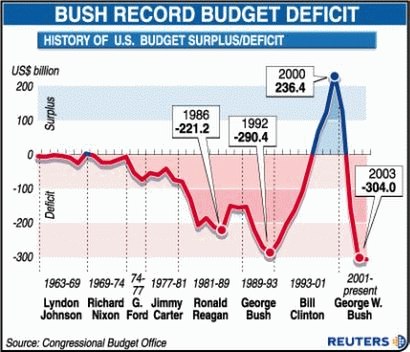

As you can tell by this graph, the economy has been doing wonderful things. Seems like G. Davis and G. Bush may be the same people.  | ||

| DL (Darth550)

Junior Member Username: Darth550 Post Number: 125 Registered: 7-2003 |

Dave, Nice pic. Remember how to tell if Dole had sex with his wife? She has pen marks all over her back. DL | ||

| DL (Darth550)

Junior Member Username: Darth550 Post Number: 122 Registered: 7-2003 |

BLAH BLAH BLAH! Yeah! Things are great! "Personal Bankruptcies Continue to Surge" The Associated Press Monday, August 18, 2003; 5:15 PM NEW YORK - Personal bankruptcies continued at a record pace in the 12 months ended June 30 as Americans struggled with the debt they took on in the 1990s. The American Bankruptcy Institute said Monday that personal bankruptcy filings totaled 1,613,097 - an all-time high for any 12-month period. The figure was up 10 percent from the 1,466,105 cases filed in the 12-month period that ended June 30, 2002. The institute, which is based in Alexandria, Va., is an association of bankruptcy judges, lawyers and experts. It analyzes bankruptcy data from the Administrative Office of the U.S. Courts. Samuel J. Gerdano, executive director of the institute, said that the main reason for the surge was consumers' growing debt. | ||

| Dave (Maranelloman)

Advanced Member Username: Maranelloman Post Number: 2671 Registered: 1-2002 |

| ||

| Hubert Otlik (Hugh)

Intermediate Member Username: Hugh Post Number: 1271 Registered: 1-2002 |

| ||

| Hubert Otlik (Hugh)

Intermediate Member Username: Hugh Post Number: 1270 Registered: 1-2002 |

I've got a few more, but have to rezise. | ||

| Dave (Maranelloman)

Advanced Member Username: Maranelloman Post Number: 2670 Registered: 1-2002 |

Hubert, LOL! Good on on Gary "Condit"... Too bad he's not rotting in prison with OJ... | ||

| Hubert Otlik (Hugh)

Intermediate Member Username: Hugh Post Number: 1269 Registered: 1-2002 |

Well, since there aren't all that many images in this thread, I thought I'd give ya'll (that's for you Dave, been thinking 'bout Texas more and more, lately.) some ammo. Enjoy.           | ||

| Dave (Maranelloman)

Advanced Member Username: Maranelloman Post Number: 2668 Registered: 1-2002 |

Art, it's "they're", not "their". Law school that long ago? ;-) And, come on, Art: is your nickname "Half Empty Glass" Chambers?? So pessimistic & so bitter! You sound like Ann Coulter, Art!!! Bitter, bitter, bitter! Finally, "fiasco in Iraq"? You mean the one where the UN geniuses REFUSED to allow us to fortify their building, even though we showed them the intel indicating a strong probability of a car bomb attack soon? Because these UN geniuses wanted to project a "friendlier, more open image" to Iraqis? So, guess what? The thugs attacked the least-fortified easy target! You mean that fiasco? I'd sure like to see you try to make that our fault, Art. Please, make my day. | ||

| Nebula Class (Nebulaclass)

Member Username: Nebulaclass Post Number: 392 Registered: 11-2002 |

Fiasco in Iraq? *yawn* The Energizer Art - He keeps bashing and bashing and bashing....... | ||

| arthur chambers (Art355)

Intermediate Member Username: Art355 Post Number: 2430 Registered: 6-2001 |

After the fiasco in Iraq, and the recent bombings, which will probably cause the non-governmental aggencies to withdraw unless we up the ante on security (causing us to put another 25 to 50k more young kids into Iraq), we will be taking out of the US about what the stimulus package would be. That doesn't bode well for our economy. Terry is probably right, and think about this: these low rates and high appraisals caused people to refinance their homes, and they took some money out of their house, spent it, and now if the market slows down (which it is now doing in most of California), the banks will realize that they are unsecured on their loans. Remember what happened to the Japanese banking system when their inflated real estate finally came back to earth? Their still in that recession, and have been for the last 10 years. We may be in for the same deal. Art | ||

| Ronald C. Steinhoff (Buylowsellnever)

Junior Member Username: Buylowsellnever Post Number: 88 Registered: 9-2002 |

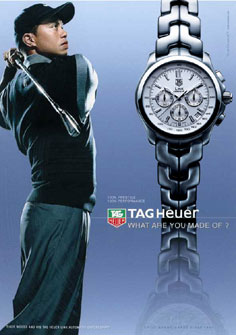

The forthcoming b|tch slaps in this thread are brought to you by: Tag Heuer, makers of fine watches  and The Government of Canada  | ||

| J Haller (Jh355)

Junior Member Username: Jh355 Post Number: 102 Registered: 6-2003 |

Terry, "Blessed is the man who, having nothing to say, abstains from giving us worthy evidence of the fact." George Eliot | ||

| Terry Springer (Tspringer)

Member Username: Tspringer Post Number: 755 Registered: 4-2002 |

Lawrence.... I see your point, and follow the reasoning and would perhaps agree except: Supply. The treasury will be issueing new bonds on a level never seen before. I dont think the market can continue to absorb all of this continueing new supply AND support current price levels. Not only will the bond market be expected to handle all of the normal quarterly re-fundings of expiring treasuries, but all of the new supply. It will top $80 Billion in Q4 alone. Also, the markets just dont believe the Fed. The Fed says its going to keep short term rates low for a long time but who cares what they say. The actions of the Fed over the past 8 months have done a number on their credibility with traders. The market will price in its own expectations and discount what the Fed says its going to do. We are seeing that already. The widening yield curve between short and long maturities will continue. | ||

| Lawrence Coppari (Lawrence)

Member Username: Lawrence Post Number: 748 Registered: 4-2002 |

I think long term rates will fall because the Federal Reserve is serious about keeping short term rates low. At some point investors are going to realize that short term rates are going to remain low. That makes long term rates attractive. Buyers will be back, bond prices will rise, and long term rates will go lower. | ||

| Terry Springer (Tspringer)

Member Username: Tspringer Post Number: 754 Registered: 4-2002 |

Uhhhhhhhhh JH. I own a mortgage company. Every wholesale lender we do business with is still working through a backlog of applications from June through early July. No cost rate lock extensions have been granted in most cases because its the underwriting delays that are causing locks to expire. The backlog will take another 3 weeks to a month to really work its way through and get us back to typical turn times. Tax refund and rebate checks have been hitting over the past month. A powerful stimulus, no doubt. Thats why I expect retail sales to do so well in Q3 and through to Q4. The question is what about after that? Rates will continue to rise. Tax rebate checks are a one time pop. Capital spending is not increasing. Consumer liquidity resulting from cash-out refinancing will drop by 75% from its May-June peak. Unemployment remains high, and while new claims are down continueing claims increase. Where is the continued growth next year going to come from when the current stimulus effect runs out and higher rates begin to really impact the numbers? | ||

| J Haller (Jh355)

Junior Member Username: Jh355 Post Number: 101 Registered: 6-2003 |

Terry, Ever bought a house? Historically you close in 30 days, in June the brokers were factoring in an extra 15 days for the boom, or 45 days. In other words, all June mortgages are closed period or they were bumped to the new higher rates. If you really want to understand what�s going on in the consumers mind, look at Wal-Mart�s web page under their quarterly close numbers, it will tell you when consumers are spending their money. Understand Wal-mart accounts for 2% of GDP that is why this one company is so important. And by the way, their numbers were up the last two weeks of July. JH | ||

| Terry Springer (Tspringer)

Member Username: Tspringer Post Number: 753 Registered: 4-2002 |

Its real interesting how every week the headline claims number drops dramatically... but last weeks headline number is revised up. Perhaps a bit of economic engineering going on? Also.... the continueing claims numbers was up by a good bit. So, while actual new job losses are slowing, those who have lost their jobs are not finding replacements. Thus, the overall employment picture is still very questionable. However, I would expect the markets to ignore that reality. Consumer spending has been driven to a large degree over the past 2 years by massive cash-out mortgage refinancing. That is coming to an end with the increase in interest rates. We are not yet seeing any impact in the numbers from this because mortgage companies are still closing their backlog of applications from the June historic lows. However, new loan applications are down big time. The dramatic slowdown in refinance activity and the resulting loss of overall consumer liquid funds is going to make it very hard for the consumers to keep up current spending levels. Were also not facing any large pent-up demand on the consumer front. Productivity gains in the corporate world have been such that costs are being lowered while output is increased without having to expand the workforce. This is going to make it tough for the employment picture to really make gains. We are not seeing large gains in corporate capital spending. Unless sales and revenues really pick up, I doubt we will see the type of gains in cap spending that will be required to offset any decline in consumer spending. How is GDP going to continue to increase at 4%+? Look for interest rates to continue their climb. Even if economic numbers begin to show that the "recovery" is going to be in the 2.5% GDP range and not the 6% range some analyst are currently claiming.... the bond market will continue to aggressivly sell off. Why? Supply. The coming budget deficits are going to flood the markets with new supply on a level never seen before. All of this new supply coming to market is going to make meaningful price gains in treasuries just about impossible. Rates will continue up, putting even more pressure on a strong economic recovery. The stock market? I have no money there currently. Consider: Currently insider selling is at a peak as is "small investor" buying. Now when the insider is selling and the little guys is buying I dont consider that a positive market indicator. Also, the markets have already priced in a strong (4.5%+) recovery going forward. I think 3% may be possible.... maybe even 4% for a couple of quarters, but the market is already pricing in more. When the numbers dont support that, the market will not be happy. The rising interest rates will also become a bigger problem. Higher bond yields will put the recovery in question and will look attractive to investors as an alternative to an overbought stock market. Im anticipating that 3Q growth is going to look pretty good. My guess is probably 3.8% to 4.5%. The real impact of the rising rates will come in Q4, but will be offset to a degree by the Christmas season. My guess on Q4 is 4% GDP or so. After the first of the year, when 10 year bond yields hit 6%+... it will cool quickly. The unemployment rate will stay at 5.8% or more, capital investment will stay flat or show only small gains, consumer spending will taper off, interest rates will slow their rate of increase but will not dip below a 10 year yield of 5.5%, Home sales and new construction will begin to slow and we will see 2004 1Q at 2.1% and Q2 at 1%. This is going to lead to a real mess in Federal deficit spending..... causing even higher rates and thus putting more pressure on the recovery. I put chances at dipping into a fresh recession in the second half of 2004 at 50%. Then again.... I may be wrong! | ||

| Ronin (Ronin)

Junior Member Username: Ronin Post Number: 72 Registered: 6-2003 |

cool..I'd still like to see cap spending bump....which it should... | ||

| Ronald C. Steinhoff (Buylowsellnever)

Junior Member Username: Buylowsellnever Post Number: 87 Registered: 9-2002 |

Indeed! Does not really matter to me...I've been (well, my company) fully invested since July 2002! | ||

| Dave (Maranelloman)

Advanced Member Username: Maranelloman Post Number: 2655 Registered: 1-2002 |

http://www.foxnews.com/story/0,2933,95324,00.html |