| Author | Message | ||

| djmonk (Davem)

Member Username: Davem Post Number: 443 Registered: 1-2002 |

Patrick, you have a lot of fans!! Would very much appreciate an email. [email protected] | ||

| Greg (Greg512tr)

Junior Member Username: Greg512tr Post Number: 228 Registered: 2-2002 |

Ok patrick..while you are sending I am at [email protected]. Thanks. | ||

| Jean-Louis (Jlm348)

Member Username: Jlm348 Post Number: 723 Registered: 11-2002 |

Patrick could you please sen it to [email protected] | ||

| Nick (True)

Junior Member Username: True Post Number: 58 Registered: 6-2002 |

Patrick, would also appreciate a copy of your spreadsheet template. Thanks. [email protected] | ||

| Kevin Butler (Challenge)

Junior Member Username: Challenge Post Number: 212 Registered: 9-2002 |

Patrick, one more please? Thanks! [email protected] | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 32 Registered: 6-2003 |

Just sent it to everyone else who asked so far. If anyone else wants it, just ask.  | ||

| Andrew S. (Andrew911)

Junior Member Username: Andrew911 Post Number: 53 Registered: 9-2003 |

Pat- I apologize as well for asking late. Please e-mail the model to [email protected] Thanks- Andrew | ||

| Crusing (Crusing)

Junior Member Username: Crusing Post Number: 118 Registered: 10-2002 |

Patrick: I know I'm late... but if you could be so kind to send to me as well. Thank you. [email protected] | ||

| Andrew S. (Andrew911)

Junior Member Username: Andrew911 Post Number: 51 Registered: 9-2003 |

Ben- I'm waiting for the day banks to start offering 40 year mortgages based on higher home prices & increased life expectancy....for first time home buyers, it seems to be getting harder and when that happens, people seem to just leverage themselves up even more unfortunately. I'm kidding around about 40 year mortgages, but I wouldn't be surprised if I saw it... I will say the best thing I did was stay home after college for 6 years to save up to buy a place and not rent. Just wound up hanging out at friends places a lot and not bringing dates back to my place- ha! As far as rental property profits, it seems prices are very high, but over time I think its a good investment if your a hands-on kind of investor that will dedicate the needed time for research, maintenance, etc. People may say there is a real estate bubble, but over time I think its still a great investment...bricks & morter you can touch & feel, people will always need a place to live, etc. My 401K statement & mutual fund investments are only a piece of paper. To answer John's original post on number of rental properties owned, I just started a few months ago and have 1. Gotta start somewhere.... | ||

| Michael Basic (Sensational1)

New member Username: Sensational1 Post Number: 26 Registered: 2-2003 |

Could you also possibly send it to me? Would be much appreciated. [email protected] | ||

| Ben Cannon (Artherd)

Intermediate Member Username: Artherd Post Number: 1048 Registered: 6-2002 |

Jim- neither do I truth be told. BTW the $400k figure is COUNTY wide average up here, in a fairly rural area north of the golden gate and north of Marin county. Makes me wonder if there's any end in sight. Somehow I doubt it. Best! Ben. | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 31 Registered: 6-2003 |

Sent it to everyone who's asked so far. If you sent me a PM or haven't received it yet, then I didn't get/see your message. On an related note, are there any southern CA realtors on the board? If so, please contact me.  | ||

| Tim G (Timgos)

Junior Member Username: Timgos Post Number: 59 Registered: 3-2003 |

Patrick, Could you send me a copy of that spread sheet as well? Thanks  [email protected] | ||

| Mfennell70 (Mfennell70)

Junior Member Username: Mfennell70 Post Number: 182 Registered: 7-2001 |

Yep. No kidding. The guy is bleeding cash and something is better than nothing. | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1940 Registered: 7-2002 |

what...2 employees cost less than 6 employees in the same space? Hmmmm. A guy I know in Dallas is scooping up some commercial strip type centers. Not sure on details though... | ||

| Mfennell70 (Mfennell70)

Junior Member Username: Mfennell70 Post Number: 181 Registered: 7-2001 |

You guys all seem to be talking residential rentals. What about commercial? Or retail? Commercial rentals are soft here. We just got someone to agree to let us sublet office space (about 5000 sq) and pay by the person! Good time to buy? I don't know. | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1938 Registered: 7-2002 |

I don't understand the SFH phenominon. I understand supply and demand, but how can anyone afford a home in an area that was just about decimated by the silicon valley/dot com bust? Sure Cali pays more based on cost of living, but if you make $50K in Dallas you don't make $200K for the same job in Cali. | ||

| Ben Cannon (Artherd)

Intermediate Member Username: Artherd Post Number: 1046 Registered: 6-2002 |

Patrick; if you could shoot me that spreadsheet I'd be very thankful. Prices just keep going up and up around here, median SFH home price just went above $400k. Best! Ben. | ||

| Rikky Alessi (Ralessi)

Member Username: Ralessi Post Number: 401 Registered: 5-2002 |

I would also like this if you don't mind. Thanks. [email protected] | ||

| Kevin S. (Wolfgang5150)

Junior Member Username: Wolfgang5150 Post Number: 65 Registered: 5-2003 |

Patrick: Could you e-mail me that spreadsheet as well? Thanks in advance. [email protected] 'Excel geek' | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 30 Registered: 6-2003 |

Found this online: What is a Gross Rent Multiplier ? "Gross Rent Multiplier is a capitalization method for figuring the rough value of a property. Gross Rent Multiplier (GRM) The Gross Rent Multiplier (GRM) formula for value is as follows: Value = Potential Annual Gross Income X Gross Rent Multiplier For Example: $1,200,000 = $150,000 (Potential Annual Gross Income) X 8 (Gross Rent Multiplier) Where do I get the Gross Rent Multiplier number to use in the formula? Usually an appraiser or loan officer will calculate GRM's from comparable closed sales in the immediate area and then average them to one number. They take the closed sales prices of the comparables and divide them by the respective Gross Incomes. The immediate area used for comparables surrounding most subject properties will fall into a narrow GRM gap. However, GRM's can vary considerably depending on the location. For an example, Beverly Hills, CA or Manhattan, NY will have a much higher GRM than a small town in the Midwest. Here's an outdated list of CA sales but it's an example: http://www.commercialrealestatela.com/mls.htm | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 29 Registered: 6-2003 |

Jim: To put it simply, yes. The GRM varies greatly though so one place might be 3, while another might be 12. It all would depend on many factors. | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1937 Registered: 7-2002 |

what is GRM? Gross Rent Multiplier? meaning what? rent is 500 a month, 5 units is 2500 a month times 12 is $30K a year gross rent so the price should be 4/5/6/7/8 times that #? So with a GRM of 4 the price should be $120K? | ||

| Anthony Griffin (Redjeeper)

Junior Member Username: Redjeeper Post Number: 87 Registered: 10-2002 |

Patrick, can you email me a copy of the spreadsheet also. The area I live in is good it is a smaller city and there are plenty of pieces of property that cash flow for under $25,000. I am looking at purchasing a block of fifty houses from a retiring investor and may have a GRM of 4. That is smoking. Wish me luck in the negotiations. P.S. My email is [email protected] | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1935 Registered: 7-2002 |

another friend of mine got his deals from an older gentleman who was liquidating his portfolio after holding it for years. So he had plenty of profit to work with and my friend got a good deal too. Timing/connections and then the ability to act. | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1934 Registered: 7-2002 |

Yeah still doing the mobiles and getting about 30% roi. I am basically renting them though as the owners come and go with the wind. Nice to take their deposits each time, but I get tired of worrying if I am going to get paid this month or not. With a multi unit at least you dont have 100% vacancy if somebody bails on you. Cruising: good point. you are right. My father in law does oil/gas and most of the things he buys are never available to the avg joe. | ||

| Crusing (Crusing)

Junior Member Username: Crusing Post Number: 116 Registered: 10-2002 |

I'm not sure what kind of connections you have but to find deals that cash flow and don't need major repairs you have to have an agent or broker who can locate the properties before they go on the market, because once they do they are gone that day. I just put a deal together this week for two four plexs @ $200,000 each. They generate $1900/month. With zero down it will cost me about $1350/month on each building. Nice cashflow if they stay rented. But I would never had gotten them without the connection. You have to get to know someone who's good. | ||

| Fred (I Luv 4REs) (Iluv4res)

Member Username: Iluv4res Post Number: 530 Registered: 8-2002 |

Jim, weren't you doing mobile home sales/financing/renting? I thought you were doing well and getting 17%+ returns???? I mentioned to you at that time, not to own rentals where you don't own the underlying land. Also that the quality of tenants may make it difficult to keep a multiple property portfolio working smoothly. Now, if you can own the trailer park (land) and rent the plats to others, that's a great investment. Not much maintenence, etc... | ||

| Fred (I Luv 4REs) (Iluv4res)

Member Username: Iluv4res Post Number: 529 Registered: 8-2002 |

Patrick, I would like a copy of the Excel worksheet too!! [email protected] Thanks! | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1933 Registered: 7-2002 |

If your willing to give the sheet away I would love to have a copy. [email protected] Yes SFR just don't work in Dallas unless you bought them 10 years ago. A $150K house will rent for maybe $1000 so that means you gotta put down $50K just to break even. Nuts. | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 28 Registered: 6-2003 |

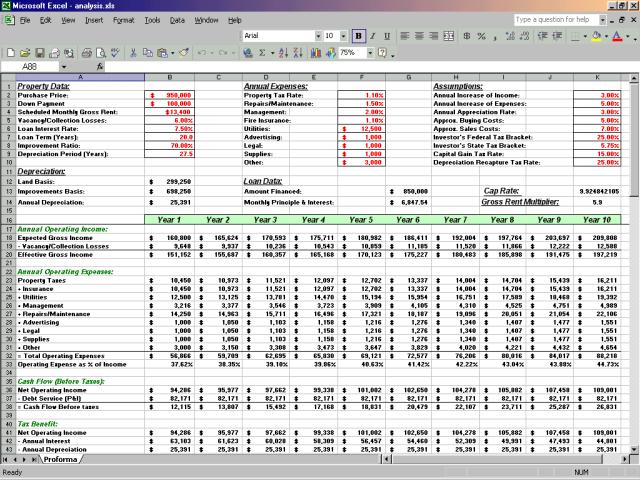

Here's a snapshot:  | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 27 Registered: 6-2003 |

Jim: I believe it's from a private investor who does the 100%. It's 1 loan, not an 80/20 or a variation of that type of loan, and has no MI. We're just using them as short-term (12 months or so), then we'll refinance the 2 into probably 15 year fixed loans. I hear you on the cash flow problem, as CA prices are crazy also. The properties that seem to cash flow in my area are mostly apartment buildings with 10+ units at a GRM of around 6 or less. It's almost impossible to find those prices though as the norm it seems are 8+ and even higher multiples. They're also not in the best area though, but the ratio of rents to price is always best in the cheaper neighborhoods. If you're even thinking of purchasing SFH's with cash flow, then you might as well stop now as that will hardly ever happen. As far as borrowing on the commercial (5+ unit) properties, I'm not yet in that league, but quickly learning the ropes so that in the future I'm ready to pounce if I happen to stumble onto a good deal. I have an Excel spreadsheet that crunches all the numbers for me if I ever see a property and want to evaluate it. Just using it for research purposes right now, and you just have to type in the info on it so it's been a big help. If anyone wants to see it, feel free to contact me. I received it from someone else on CREO, and added some other fields for my own benefit (such as cap rate, etc) so it's pretty handy. | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1931 Registered: 7-2002 |

I agree fred. just seems that everybody has brokers involved that tell them a prop is worth X so they won't take less. I have a motivated seller of a mobile home park that needs some work, but it sort of scares me as i am having trouble with a mobile I have now. Pretty sucky clientele who don't pay and will walk at the drop of a hat leaving me holding the bag! creo is creative real estate online www.creonline.com Lots of good info there from investors who do this every day. | ||

| Fred (I Luv 4REs) (Iluv4res)

Member Username: Iluv4res Post Number: 527 Registered: 8-2002 |

What is CREO? Jim, alhtough I missed out on a lot of opportunities now that I look back on what real estate has done over the past few years, I still will keep my same mindset. "you make your money when you buy". In other words, if the property doesn't have a positive cash flow, walk away! Never count on future value with a zero or negative cash flow property. This is what started the 'greater fool' theory of the internet stock era. Yes, it's probable that the prop will be worth more in the future, but you also will need to get paid for the time and expense of running and maintaining it over that time period. | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1930 Registered: 7-2002 |

Yeah I visit creo, but havent' been there in awhile. My fico was 740 last time I checked about 3 months ago. Are you saying you have a bank that does 100% LTV or a private investor? My problem is finding a property that will cashflow with 100% financing. Seems I have to put down about 30% or more in cash to get it to just break even. On a $400K property that is $120K to get nothing in return other than increased value over time. | ||

| Patrick (Patrick)

New member Username: Patrick Post Number: 26 Registered: 6-2003 |

Hey Jim, Are you also on CREO often? I could have sworn that I might have seen your name on posts there. I'm in CA, but if it helps, my mortgage broker can do 100% LTV's on NOO's with 4 months reserves and a decent FICO. Closing on 2 deals here probably this month. The investor also allows 3-6% seller contribution so out of pocket expenses are minimal. If you need a referral or just want to chat, feel free to contact me. ;) | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1928 Registered: 7-2002 |

Just getting started so don't have a mil sitting around to invest so yes I need the 95% LTV type things. Don't care on location really if it pays. Here is what I am afraid of. Buy a big ole expensive place then it has high vacancy and I go broke waiting for market to turn. I know they say to buy when nobody is buying and sell when nobody is selling. Jason: as for the billboard question I am not sure, but my wife's grandfather has 9 of them. I think he gets about $7000 a month total from an advertising company who paid to put the boards up and they secure advertising. So basically he gets $7K for letting them put them on his land adjacent to the highway. | ||

| Marc A. Thurston (Btownv12)

Junior Member Username: Btownv12 Post Number: 54 Registered: 11-2002 |

John & Jason - Over the last 10 years I have brokered about 10,000 apartment units. I have worked with first investors all the way up to one guy who owned 30,000 units. Most of the investors that I have worked with, will tell you that between 75-100 units it starts to become a full time job or requires a professional management company. If you approach real estate with a long term outlook and treat it as a business it can be a wonderful investment. For those just starting out with your first investment, try the following strategies; A. Study your local market and learn the resale values and the rent levels. Work with a knowledgable "apartment broker". Not everyone who sells real estate, has exeprience selling apartment buildings. B. If you have not purchased your first house, consider buying a duplex, triplex or fourplex and then living in one of the units. You will get a tremendous education about owning investment property, by living near your tenants. Financing is much easier to obtain on four units and smaller buildings. C.If you want to start with an investment larger than a fourplex, then seek out a friend who is a successful investor, and see if he would be interested in being a partner. You provide a portion of the equity and he provides his knowledge and equity. Best of luck | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3150 Registered: 4-2002 |

YEA RALPH, BUT THEY DONT BUY ENERGIZERS  | ||

| Ralph Koslin (Ralfabco)

Member Username: Ralfabco Post Number: 892 Registered: 3-2002 |

BRUCE: ASHKENAZI ARE CHEAP AND THRIFTY !! THEY BUY ON-SALE BATTERIES WITH SHORT SHELF LIFE. | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 470 Registered: 2-2002 |

1 dinner is fine...gotta be 'Le Cirque', though. | ||

| Fred (I Luv 4REs) (Iluv4res)

Member Username: Iluv4res Post Number: 522 Registered: 8-2002 |

Holy cow Todd, speaking of RE, is that your house in your profile?????? | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3149 Registered: 4-2002 |

OK, MARQ YOU WIN...2 DINNERS AT MY EXPENSE WHEN YOU/BARBARA COME DOWN....IS THAT WHAT YOU WANTED TO HEAR??  | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3148 Registered: 4-2002 |

RALPH THE ONES THAT HAVE THE "GELT" | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 469 Registered: 2-2002 |

It kills me to say this again but....Bruce, you're right. | ||

| Ralph Koslin (Ralfabco)

Member Username: Ralfabco Post Number: 891 Registered: 3-2002 |

BRUCE: WHICH PART OF THE FAMILY ??? | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3147 Registered: 4-2002 |

RALPH ALWAYS KEEP THE LINES OF COMMUNICATIONS OPEN AND POSITIVE WITH FAMILY MEMBERS  BRUCE | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 468 Registered: 2-2002 |

Bruce, I gotta agree with you. Without a doubt, bar none, "Old money is the best money"; no exceptions.... | ||

| Ralph Koslin (Ralfabco)

Member Username: Ralfabco Post Number: 890 Registered: 3-2002 |

Oops double post. ~ BRUCE I KNOW YOU !!!! | ||

| Ralph Koslin (Ralfabco)

Member Username: Ralfabco Post Number: 889 Registered: 3-2002 |

I am looking into becoming a slum lord. I just obtained listings from my agent. I can't wait to become a baby sitter. Bruce I liked your comment: It reminds me of my father who bought some homes for 15K that are worth a few more dollars today. | ||

| John (Cohiba_man)

Member Username: Cohiba_man Post Number: 304 Registered: 1-2003 |

QUOTE:"Rock-n-roll icon Jon Bon Jovi and local real estate developer Craig A. Spencer have given the city of Brotherly Love some Soul with the Arena Football League�s newest franchise. The Philadelphia Soul is scheduled to kickoff in February of 2004 and will split its home games between The Spectrum and the Wachovia Center." FOund a news article, very cool. | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 467 Registered: 2-2002 |

I beleive that there are still 'bargains' to be had; at least in my area (DC-MD-VA). Are you willing to pick up properties in 'less than desirable' neighborhoods or do you insist on prime areas? Do you have a chunk of cash available or will you need to finance 95% of it? | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3146 Registered: 4-2002 |

JIM THE KEY IS "OLD MONEY" ITS TAKES A FORTUNE TO MAKE SOME PROFIT THESE DAYS. AND UNTIL THEN, YOU KEEP YOUR FINGERS CROSSED..YOU HAVE TO BE VERY WEALTHY AND KNOW THE TRICKS AND GOOD PEOPLE MY .02 CENTS | ||

| Jason W (Pristines4)

Member Username: Pristines4 Post Number: 736 Registered: 12-2002 |

Alittle OT, but does anyone know how to purchase billboards? | ||

| Ralph Koslin (Ralfabco)

Member Username: Ralfabco Post Number: 888 Registered: 3-2002 |

I am looking into becoming a slum lord. I just obtained listings from my agent. I can't wait to become a baby sitter. | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 466 Registered: 2-2002 |

Got it...we'll talk.  | ||

| Jim Schad (Jim_schad)

Intermediate Member Username: Jim_schad Post Number: 1927 Registered: 7-2002 |

So how do you suggest you get started on brick and mortar buildings? Do you look for a steal or just pay the going rate then wait? Everything I look at costs a ton of cash plus financing just to make it break even let alone produce a positive cash flow. Seems on the multi units you can cash flow easier, but the price goes up out of my league. | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3145 Registered: 4-2002 |

HEY BUDDY I SENT YOU AN EMAIL, EARLIER.. LOVE YA BRUCE | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 465 Registered: 2-2002 |

That's the ticket, Bruce! I know where the building is located; PRIMO is the word, my man! | ||

| Bruce Wellington (Bws88tr)

Advanced Member Username: Bws88tr Post Number: 3144 Registered: 4-2002 |

MY GRANDFATHER ABOUT 80 YRS AGO BOUGHT A 6 STORY BLDG IN A PRIME REAL ESTATE SECTION OF NYC SINCE THEN, 3 GENERATIONS ARE LIVING WELL AFTER THAT AQUISITION, AS WE RENTED OUT TO A FAMILY FOR THE LAST 30 YRS AT A NET NET LEASE, WE DOING NOTHING TO THE UPKEPT OF THE BUILDING, JUST 1X A MONTH TO COLLECT THE CHECK... THANKS TO MY GRANDFATHER...ABOUT THE ONLY THING HE DID RIGHT.... | ||

| todd spencer (Todd)

Junior Member Username: Todd Post Number: 83 Registered: 5-2003 |

Speaking of portfolios my brother Craig Spencer and Bon Jovi just bought the Philadelphia Soul AFL team. Am I proud...Damn right! | ||

| todd spencer (Todd)

Junior Member Username: Todd Post Number: 82 Registered: 5-2003 |

My father and brother own or lease or have under management approx 4 million sq. ft with a value of over 1 billion dollars. Now thats a portfolio. | ||

| John (Cohiba_man)

Member Username: Cohiba_man Post Number: 302 Registered: 1-2003 |

Whoa, what do you do in ADDITION to owning 200 units!? Fred, thanks for the reply, how many units do you own? | ||

| Marq J Ruben (Qferrari)

Member Username: Qferrari Post Number: 464 Registered: 2-2002 |

A bit shy of 200 units (2 larger multi-story buildings, 1 low-rise bldg.), resident managers in the 2 lg. bldgs., maintenance/engineers in the 2 lg. bldgs. One family member runs the whole deal in 20-30 hrs/wk. @ a salary of $150K. Cannot and do not spend a lot of time there as this is not my main source of income. This year, so far, I have been on site maybe 3-4 times. Not as difficult as some may make it sound. They almost run themselves; seriously. Very rare to have someone late w/rent. If they are, just call the lawyer and a letter goes out; simple. I would never go with a management firm. Maybe this is the exception rather than the rule, but I can only comment based on my experience. | ||

| Fred (I Luv 4REs) (Iluv4res)

Member Username: Iluv4res Post Number: 519 Registered: 8-2002 |

John, since you asked here and in my post about my new truck, I'll try to answer you. I know of no other investment where you can put $ and virtually guarantee that in 10+ years it will be worth more than you bought it for. I am a huge RE fan since it has been good to me. That said, I warn anyone who wants to become a real estate investor, it's not like what you see on TV. I do not know any people who are successful RE investors that sit on their yacht or by the pool just cashing checks. It involves a LOT of work. Repairs, expenses and dealing with tenants is not for the faint-of-heart or someone just looking for a passive investment. Regarding # of units: I know someone who wont look at anything under 200+ units. However, he has lost sight that not everyone has the $ to buy that many at a time. Obviously, there's an economy of scale when you buy multiple units together. Plus with large projects, you can have on-site management. | ||

| Jason W (Pristines4)

Member Username: Pristines4 Post Number: 735 Registered: 12-2002 |

Good question John. I am also interested. | ||

| John (Cohiba_man)

Member Username: Cohiba_man Post Number: 301 Registered: 1-2003 |

I've noticed MANY people on this site seem to own rental property, so I'm curious, how big are all of your real estate porfolios, in terms of number of units? At what point did it become necessary to hire a management firm (if you have)? |