|

The

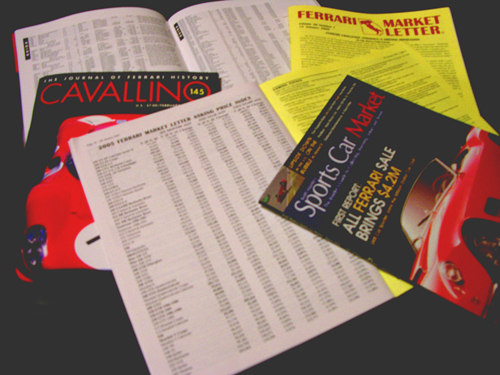

following article first appeared

on my Mercato Ferrari web log as a

two-part piece published on February

17 and 26 of this year. Since that time,

the issue of market guide confusion has continued to pop up with regularity both on FerrariChat and in outside

discussions, making it painfully obvious exactly how small the Mercato

Ferrari audience really was. Once

again, here is the entire piece in its

original form followed by comments

and updated information. The

following article first appeared

on my Mercato Ferrari web log as a

two-part piece published on February

17 and 26 of this year. Since that time,

the issue of market guide confusion has continued to pop up with regularity both on FerrariChat and in outside

discussions, making it painfully obvious exactly how small the Mercato

Ferrari audience really was. Once

again, here is the entire piece in its

original form followed by comments

and updated information.

PART ONE:

Pricing

out PF Coupes or Cabs lately? How about Lussos? 4-Cams? Checked out all of

the market guides only to

find that you're no more well informed than when you started? You're not

alone. Lately, more and more people

seem to be confused by the odd disparity of Ferrari values presented in the

various market guides, something

that's not surprising when you consider the following:

250 PF Cabriolet

series II

Cavallino (Guida

Feb/Mar 05):

$225,000 -

$300,000

Sports Car Market (Price

Guide

2005):

$175,000 - $300,000

Ferrari Market Letter (Asking

Price Index

Feb 12, 05):

$143,696

250 PF Coupe

Cavallino (Guida

Feb/Mar 05):

$65,000 - $125,000

Sports Car Market (Price

Guide

2005):

$75,000 - $125,000

Ferrari Market Letter (Asking

Price Index

Feb 12, 05):

$57,447

250

GT/L

Cavallino (Guida

Feb/Mar 05):

$240,000 - $350,000

Sports Car Market (Price

Guide

2005):

$250,000 - $350,000

Ferrari Market Letter (Asking

Price Index

Feb 12, 05):

$182,750

275

GTB/4

Cavallino (Guida

Feb/Mar 05):

$450,000 - $495,000

Sports Car Market (Price

Guide

2005):

$425,000 - $500,000

Ferrari Market Letter (Asking

Price Index

Feb 12, 05):

$348,000

Now, any hominid can see that something's wrong with this picture. Is the

Ferrari Market Letter trapped

somewhere between the Triassic and Jurassic periods or what? Well, the

answer is yes and no. Before I comment

any further, let's let the Ferrari Market Letter's own self-proclaimed

dinosaur, Gerald Roush,

explain how he

comes to the figures published in his Asking Price Index:

FERRARI

MARKET LETTER ASKING PRICE INDEX

Originally

published in Vol. 27 No. 22

There seems to be

quite a number of misconceptions about the Ferrari Market Letter Asking

Price Index published in

each issue of the Ferrari Market Letter. People try to make more out of it

than it is, try to make it out to be something

it was never

intended to be, criticize it for not being what they want it to be.

At the risk of

sounding like an old curmudgeon, I believe part of the problem stems from

the influx of newbies into the

Ferrari world over the past decade or so. They donít recall or canít

remember what the Ferrari world was like when we

first

started the regular Asking Price Index (A.P.I.)óprobably because they

werenít active in the Ferrari market then.

At that time,

as the 80s ended and the 90s began, the Ferrari market was in a price

turmoil. Prices had shot up drastically during the late

80s, in some instances doubling every year, then went into a steep decline

in the early 90s.

In the earlier

days of the Ferrari Market Letter, the late 70s and into the 80s, I only

published a price analysis every six

monthsóin January and July. The stability of the market in those years

required nothing more. But as the market

destabilized there seemed to be a need for a more frequent and up-to-date

analysis. Hence the every issue format that

has

prevailed for the past 12 or so years.

In both its

earlier incarnations and its present form any price analysis published in

the FML has been calculated using

asking

prices. Thatís why itís called the Asking Price Index. This policy is a

regular source of criticism. Why not, I am

often asked,

use actual selling prices? But after publishing the FML for 27 years I think

I have some experience in the matter and I have yet to find any source for

reliable, accurate and verifiable actual selling prices in the quantities required to make any analysis

statistically relevant.

A number of

solutions to this problem have been suggested. Why not use auction figures?

But do dealer wholesale

auctions

such as Manheim truly reflect the retail market? It is the retail market

where most subscribers operate. The

public auctions

such as RM, Bonhamís, Christieís and Barrett-Jackson tend toward the more

exotic (and high dollar)

Ferrari models and

while a number of the more mundane Ferraris do go through these auctions the

quantity is not

sufficient.

What about public

records? After all, when these cars are sold taxes have to be collected so

why not use local tax re-

cords? I

have privately invited individuals interested in reforming our price index

to approach their local govern-

ment bureaucracies

and ask them to extract such information on Ferrari sales. To date the

influx of such "readily

accessible, public record"

information has been nil.

As for just

asking the parties involved the amount of money that changed hands I have

found that to be somewhat

unreliable. Buyers tend to brag about how cheaply they purchased the car,

and sellers tend to brag about what a killing

they

made on the sale, and the twain often donít match!

Using asking

prices results in numbers that are almost certainly higher than actual

selling prices, because it seems

that there

is an unwritten rule that nobody pays asking price. But this overlooks the

fact that the FML A.P.I. was never intended as a

value guide. There are useful value guides out there, such as the Cars of

Particular Interest Collectible Vehicle Value

Guide

and the N.A.D.A. Classic, Collectible, and Special Interest Car Appraisal

Guide & Directory. Both of these have breakdowns by

year and give low, average and high value ranges. This is much more useful

than the FMLís one-price-fits-all number.

The FML A.P.I.

was intended as a barometer showing where the market was headed, which is

why figures from the past

are

also shown. That was important when it was first created because prices were

changing rapidly. Maybe itís a fallacy,

but I

believe as asking prices go so go selling prices. If the A.P.I. figure for

your particular favorite model has gone up 20 percent in

the past two years then there is a good chance that selling prices have

likewise gone up 20 percent, and of

course the opposite

is true.

Keep in mind that

A.P.I. figures are not a simple arithmetic average of the cars being

advertised in that issue of the FML,

a

misconception which leads to regular criticism because a subscriber canít

duplicate the results. Prices are gathered

from

other sources, there is a time factor involved, and unrepresentative

examples are not considered. Several years

ago an astute

subscriber accurately described it as "a lagging average over many issues

that allows you to show trends, minimize issue-to-issue noise, and give an indication of the market even when no vehicles are

listed." But it does come

close to being an average

or median. For example look at the 328 GTS 1986-1988 prices in this issue.

Five of them are

under the A.P.I. figure and six are

higher.

But in addition

to telling you where the market has been and, perhaps, where it is going,

the A.P.I. can help you determine a

value. If the example you are evaluating has an asking price higher than the

A.P.I. figure perhaps there is a valid

reason.

Maybe itís a late version in exceptional condition with low mileage and

excellent records, making it more valuable. If it has

an asking price lower than the A.P.I. find out why itís so cheap. Maybe it

has a mechanical problem or a

checkered or

undocumented history.

Just donít expect

the FML A.P.I. to tell you what an individual example is worth. Use it as

just one tool to help you make

that

judgment for yourself.

So,

it would make sense that, being based on advertised asking prices and not

actual selling prices, the figures

listed in FML's Asking Price Index would reflect numbers that are higher

than those based on actual sales, right?

Again:

Using

asking prices results in numbers that are almost certainly higher than

actual selling prices, because it seems that

there

is an unwritten rule that nobody pays asking price.

So, why then are FML's numbers not only lower, but

dramatically lower than those published in both Cavallino

and Sports Car Market in the examples I provided? After all, if no one pays

asking price, then certainly no one is

paying over asking price.

The answer, I suppose, lies somewhere within that mystical formula that

Gerald uses to calculate his figures.

What I see happening is that models with asking prices that have remained

flat or have appreciated very slowly,

have listings in the API that make sense while cars that have been actively

on the rise do not. Simply put, the

FML's formula cannot keep up with market trends. If one were to review every

single 275 GTB/4 that's been

advertised for sale publicly over the past two years, I'm willing to bet

that not a single one has had an asking price

of under $350,000. The same can be said for Lussos listed for under

$185,000. Where are these advertised cars?

It's also possible that Gerald's using only figures from cars

offered for sale in North America, which might also

contribute to the discrepancy. In the case of the samples I've chosen above,

the PF Coupe, Cab II, Lusso and 4

Cam, few have been offered on this side of the pond over the past year or so

and the weak dollar makes asking

prices in Europe much higher by conversion than they would have been only a

couple of years back.

So, what to make of the FML's API? Personally, I think it does a decent job

of reflecting asking prices for every

model after the 275 GTB/4 (365 GT 2+2 and on), where the market has been

more or less flat, but that the earlier

cars are appreciating at a rate that the API's formula just can't keep up

with.

PART TWO:

In Part I of this piece, I addressed the concerns of the

market-curious who find the discrepancies between

various market and price guides to be confusing. Focusing first on the

Ferrari Market Letter and quoting the

FML's Gerald Roush, I attempted to shed some light on the methods used in

developing his Asking Price Index

and went on to explain why, in the case of older, collectible

Ferraris, the FML's figures are consistently lower

than those presented by its rivals and seem to fall far short of current

asking prices.

In this installment, I'll be dealing with those two rivals, Cavallino and

Sports Car Market, but first I want to

address a question posed by one of my readers who asked why I had chosen to

focus on these three sources while

ignoring the other two mentioned by Mr. Roush, the Cars of Particular

Interest Collectible Vehicle Value Guide

and the N.A.D.A. Classic, Collectible, and Special Interest Car Appraisal

Guide & Directory. To answer that

question, the whole purpose of this two part piece is to address the

questions and concerns of my readers and other enthusiasts, owners and

market-watchers that I come in contact with. Whenever I've been asked about

the

disparity of various market/price guides, it has

always been FML, Cavallino

and Sports Car Market that were

brought up. I've yet to have one single person quote either of these other

two sources when expressing their

confusion. If you have a specific question about the figures offered by

either the CPI or NADA guides, feel free to

ask and I'll do my best to provide an accurate answer.

Cavallino

Guida

and Sports Car Market

Price Guide

I've combined the two of these into a single segment because,

the truth is, they both use exactly the same

method to determine the values published in their guides. To learn more

about the process, I spoke to Southern

California horse trader Michael Sheehan, who not only happens to be one of

the "selected dealers" surveyed by

Cavallino for the figures published on their

Guida pages, but he also

consults with Sports Car Market on the

Ferrari values offered by their Price

Guide. With so much in common, why then do the figures in these

two

currently differ, even if only slightly? The simple reason is that Cavallino

updates and publishes their guide every

two months while SCM does so only once per year, the result being that

Cavallino's figures are more current and

reflect more recent market changes.

According to Mr. Sheehan, whenever possible, the figures he provides are

based on actual selling prices of

Ferraris worldwide. Of course, no one can possibly know the selling price of

every vintage Ferrari that changes

hands, but he is very well connected within the Ferrari community, sells or

brokers a number of these cars each

year himself and, like me, makes it a point to watch the market like a hawk.

When actual selling prices either aren't available or just aren't abundant

enough, a certain bit of common sense

(something that an arithmetic formula can't provide) is called for. Michael

refers to this as making "an educated

guess." When putting a value on one of the rarer models, it might be the

case that an example hasn't changed

hands for several years. Even so, if the market is experiencing an overall

up or down swing, it only makes since

that the value of this particular model should follow suit. In some

instances, similar models might have

experienced dramatic movement within the market place, making it reasonable

to assume that this car should be

moving similarly. For example, if 250 SWBs and 250 TdFs are both enjoying

healthy value increases reflected by

recent sales figures but a 250 Interim Berlinetta (essentially a TdF with

SWB bodywork) sale hasn't been

recorded in years, our educated guessing would tell us that Interim prices

would be affected accordingly.

Now, while this method seems to be a fairly accurate way to value some of

the more common cars that change

hands with some frequency, in the case of the rare and obscure, one can be,

and often is, surprised by actual

selling prices. After all, the buyers and sellers of 7+ figure automobiles

are few and far between and what one is

willing to pay or what one is willing to let one go for may have little to

do with what Cavallino, Sports Car Market,

Michael Sheehan or you and I think that that car is worth.

_______________________________________________________________________________________________________

When

Part I of this piece first appeared on Mercato Ferrari, it drew an

unusually hostile response from the

publisher of the Ferrari Market Letter, who took my analysis of

the situation as some sort of attack on

his

publication. It was nothing of the sort. The fact is that there exists

a large discrepancy between the figures

reflected in his Asking Price Index and some popular value guides when it

comes to several of the older models

that have been on the move over the past couple of years. His

explanation that this is due to the fact that the API

is not a "value guide" and uses asking

prices as opposed to actual selling prices does not hold up, seeing as his

figures are lower than those presented in

the other two publications that I used as examples. My intent was not

to

deride him for this, only to explain the

discrepancy to my readers, many of which had expressed confusion

over the

situation.

Whether the result of an adjustment in his formula or, more

likely, a case of FMLís methods catching up to a

slowing market, a look at the values given for these same Ferraris three

months later

reflects considerable closing

of the

market guide gap:

250

PF Cabriolet series II

Cavallino (Guida

Apr/May 05):

$225,000 -

$350,000

Sports Car Market (Price

Guide

2005):

$175,000 - $300,000

Ferrari Market Letter (Asking

Price Index

May 21, 05):

$192,289

250 PF Coupe

Cavallino (Guida

Apr/May 05):

$65,000 - $125,000

Sports Car Market (Price

Guide

2005):

$75,000 - $125,000

Ferrari Market Letter (Asking

Price Index

May 21, 05):

$71,538

250

GT/L

Cavallino (Guida

Apr/May 05):

$250,000 - $370,000

Sports Car Market (Price

Guide

2005):

$250,000 - $350,000

Ferrari Market Letter (Asking

Price Index

May 21, 05):

$276,732

275

GTB/4

Cavallino (Guida

Apr/May 05):

$450,000 - $495,000

Sports Car Market (Price

Guide

2005):

$425,000 - $500,000

Ferrari Market Letter (Asking

Price Index

May 21, 05):

$474,455

It's plain to see that, due to the

methods used, the slow-to-react Asking Price Index does not

accurately reflect

current asking prices of Ferrari models

during periods of evident and dramatic market activity, a fact that has

been the cause of much confusion. Hopefully, by helping some of you to

better understand the process behind

the numbers, we've eliminated that confusion and made it easier to take it

all in and arrive at your own

conclusion when trying to determine a particular car's value.

_______________________________________________________________________________________________________

|